Why Do I Wait Until the 27th to Purchase Major Goods?

How To Pay Your Credit Card: The Delayed Purchase Strategy

During the course of 30 some years of building financial acumen, I have discovered many financial hacks to use in my day-to-day financial life. Today I’m going to share with you one of the best hacks to extending my own personal cash cycle. So why do I wait until the 27th to purchase goods whenever possible? The answer is below!

The Idea Behind the Strategy

In my own personal financial journey, I have come to understand the importance of holding onto my cash rather than allowing others to hold it for me. Wherever possible, I look to avoid large cash deposits or outlays for certain expenses (prepays).

By holding my cash in interest-bearing, FDIC-insured savings accounts or in purchasing high-yielding dividend stocks, I ensure that my money continues to work for me on a daily basis in the form of ROI. This is one of the most important steps in the journey towards Financial Freedom.

In unison with this strategy of having my money make money for me in the form of interest and dividends, I look to utilize credit cards as much as possible in daily purchasing. I extol the benefits of using credit cards the right way, as doing so is a major way to increase one’s cash conversion cycle. This increase in the CCC allows me to have my money working in the markets for a much longer period of time.

As a reminder, I only use credit cards when I have the following criteria met:

- I make sure to never incur interest payments;

- And I always pay the balance on time and in full per the statement.

- I never buy more goods that I have the cash on hand to pay with.

Once I have these criteria met, I further extend my cash conversion cycle by delaying as many purchases as possible until the 27th of the month. You may ask, “Why the 27th of the month?” Great question!

How to Pay Your Credit Card: Extend the Cash Cycle

The key to utilizing a credit card successfully is to extend the time it takes for you to pay your everyday bills. How I pay my credit card bill is with a delayed purchasing strategy.

The beauty of this strategy lies in the simplicity of execution. It works like this:

- All of my credit cards are on the same payment cycle.

- All of the credit card due dates are on either the 21st or the 22nd of each month.

- The cards have statement cycles that are from the 27th to the 26th of each month.

- This means that on the end of the day on the 26th or early on the 27th, the purchases for that particular period are put onto that the monthly statement and billed out to me with a due date of the 21st or 22nd in the next month.

- If I delay a purchase until the 27th, it won’t hit that month’s billing, but rather the next month’s billing. This means that I will have up to an extra 60 days to ‘float’ the cash in a savings account by delaying as many purchases as I can.

Here is a real-life example:

- I have tuition fees due on 8.2.19 for $1,000. I get billed this statement from my college on 6.1.19.

- Rather than pay this right away, I put it on my calendar to pay down on 7.27.19; the date when the credit card statement closes.

- When I pay it on the 7.27.19, it will be billed on the upcoming 8.26.19 statement.

- I will then have to pay it on 9.22.19, which is roughly 60 days out with the extra float.

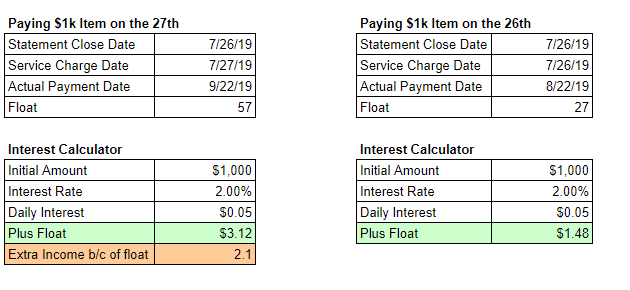

What does this look like with cold, hard numbers? Check out the example below which details what effect interest expense would have on a $1,000 purchase made on the 26th vs. on the 27th:

It might not seem like much on $1,000, but keep in mind we are earning 2x extra income if we have our savings earning money for us in a high interest-bearing checking account. The only effort to make this 2x times return is simple: delay a purchase for a day.

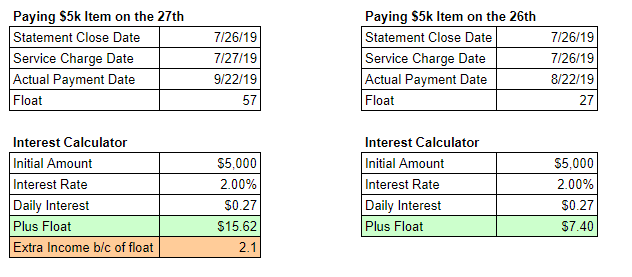

Keep in mind that the higher the expense you are delaying, the more money that stays in your pocket. Taking the example above, what happens if we increase the amount to $5,000?

I know some of you may already have this as a standard practice in your budgeting routine. I agree that this is a simple process, but I would challenge how well you are doing with the execution piece. Are you systematically delaying purchases whenever possible?

Doing so will help you maximize your cash flow and help your money work longer for you.

A few caveats to paying your credit card with the delayed purchasing strategy:

- Do not incur late fees by delaying payments.

The strategy that I am discussing here does not mean that you do not pay your suppliers or vendors on time. Rather if you have the ability to extend a payment, then, by all means, do so. But if a normal expense bill is due on the 25th and you will incur a late charge if it is not paid by then, make sure you pay that bill by the due date. This strategy loses its firepower if we are incurring late fees or interest charges on our everyday, normal expenses.

- This works best for large expenses.

The general rule of thumb is the larger the expense, the more beneficial this strategy of extended float becomes. This isn’t to say that you can’t delay smaller purchases – anything that can help your money work longer for you is helpful on the path to Financial Freedom. However, I find that I do not always practice this strategy with smaller expenses, but rather the larger ones.

Typically anything under $50 is something I do not worry about extending. In general, this strategy will become extra beneficial should you routinely obtain extra float on the large expenses that you will end up needing to pay anyways.

Examples of Delayed Purchases

Below are some examples of a few items that I have delayed out purchasing whenever possible:

- Medical bills

- Tuition

- A new grill

- Payment for Housing Services

Basically, the formula goes the bigger the item that you extend payment on, the better as that is a longer time period for your cash to be working in the market.

Added Benefits to a Delayed Purchasing Strategy:

- The delayed purchase strategy helps me when I’m going over my budgeting process as it is a method of simplification. By having similar due dates and strategies for handling my various credit cards and accounts, I am able to better plan out my cash flows. Whenever possible, I look to line up as many due dates as possible, especially with my credit cards.

- This also allows me to standardize when I’m making my purchases. By knowing that my new credit card statement generation dates are within a day or two of one another, I can make as many purchases as possible for after the 27th and be assured that I will have the extra 60 days to have the money working for me.

So what do you think of the delayed purchasing strategy to help improve your cash cycle?

Do you have a better grasp on how to better utilize credit cards in your daily purchasing?

Get the conversation started by commenting below with your stories, tips, and tricks!