September 2019 Dividend Portfolio Roundup

Hi all, September was a busy month for the MoneyByRamey.com dividend portfolio.

Between Chinese Tariff war news, a pending impeachment inquiry, and concerns on general manufacturing trends, there were ample opportunities to add positions into the portfolio.

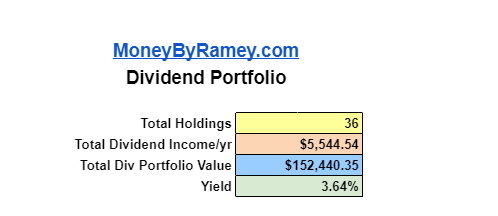

As of 10/2/19, the portfolio consists of 36 positions with a total value of $152,440.35. The annual dividend income is $5,544.54 with a 3.64% dividend yield.

Overall, the performance continues to be solid, but as I write this, manufacturing trade concerns are causing the market to drop significantly in the past few days.

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Positions Added

Wells Fargo ($WFC)

WFC was my first purchase of September 2019. With the purchase of WFC, I added 51 shares at $49.30, which increased my annual forward dividend income by $104.04.

I have been looking at the financials lately and seeing that they have become very undervalued when compared to the overall market.

With lower interest rates, concerns over emerging cryptocurrencies, and overall recession concerns, there seems to be an opportunity for a dividend investor such as myself.

Bunge ($BG)

With the relative slump in the commodity markets due to “bumper crops” the past few years running, stocks with ag sector exposure have been particularly interesting.

I have been increasing my $ADM stake in the past year, and wanted to add in $BG as well. In Mid-Sept, I purchased an additional 60 shares of $BG, which increased my forward dividend income by $120. My total BG share count is now 67.58 which yields $135.16 in total annual dividend income.

In a former life at a commodity trading firm, I worked with both of these companies and was always impressed with their breadth of operations. The world needs to eat, and $BG will be there to serve those needs.

Johnson & Johnson ($JNJ)

I was most excited to add JNJ as the 36th position in my dividend portfolio. It’s not every day that an investor gets to buy into a company that has tremendous cash flow and a better debt rating that the US government.

JNJ has recently been trading down on its potential opioid crisis exposure, which has made the stock pop up on my screener in the past month. I ended up pulling the trigger and buying 23 shares, which added $87.40 to my annual dividend income.

While my initial investment was $3,000, I am hoping to pick up $2,000+ more of JNJ shares. I often hold off on making a full position investment to see if there is a better opportunity to average down at a future time. You can read more on my JNJ investment here.

Kraft-Heinz ($KHC)

KHC is one of the most beat-up stocks of the past year or two. With a dividend cut, management change, and a $15.4B intangible asset write-down of its brand equity, things do not seem to be going well for this entity.

Yet, I’m still a large believer in the KHC story. I just think there is too much value in the Kraft name for this not to be a position in more portfolio. Putting my money where my mouth is, I added 71 more shares of KHC, which increased my annual dividend income by $113.60. This brings my total position in KHC at 132.62 shares that yields $212.19 in annual dividend income.

Newell Brands ($NWL)

I feel like a bit of hypocrite on this buy, because in my recently published book, Simple Investing: The Dividend Investing Strategy to Grow Your Passive Income, I used Newell Brands as an example of a dividend-paying stock to not buy at this moment.

My reasoning is that, while NWL does have some strong brands, the overall outlook for some of those brands is very negative. In particular, the strong name brands of Sharpie and Elmers are being rendered obsolete by new technologies being rolled out in the business world, the classroom, and elsewhere.

However, NWL is undergoing an extensive turnaround plan that seems to be paying off quite well. Cash flow in the recent quarter was particularly surprising as it covered dividends as the company continues to pay down debt and buy back shares.

Time will only tell if the turnaround will work, but I’m willing to take a chance with a smaller portion of my capital via my risk investment strategy spectrum.

I bought 41 shares of NWL, which increased my forward dividend income by $37.72. My total share count is now 108.87, which yields $100.16 in ADI.

Summary

September was certainly a busy month. October looks like it might be too. So long as Mr. Market fluctuates, a dividend value investor such as myself will find great companies at great prices.

My end goal is a dividend portfolio that generates $50,000 of annual dividend income. The MoneyByRamey.com portfolio currently generates $5,544.54 in ADI, which means I am 11.08% of my total goal and growing each quarter through DRIP!

Good luck and happy investing!

What do you think? What are you investing in? Let us know by commenting below!

Disclosure: I am/we are long $AAPL, $ADM, $BG, $BP, $BUD, $CALM, $CAT, $CMI, $CTL, $DAL, $F, $FAST, $GE, $GT, $JNJ, $IBM, $INGR, $KHC, $KO, $KSS, $MMM, $NWL, $PFE, $PG, $SBUX, $SJM, $SPTN, $STX, $T, $TSN, $UPS, $WFC, $WPC, $WRK, $WY, $XOM

Disclaimer:(1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!