6 Investing Tips for The Long-Run

In today’s read, we’ll go over the 6 Investing Tips for the Long-Run!

No matter what type of investor you happen to be or which strategy you use, everyone needs to have a solid investing rationale when deploying capital into the markets.

While my personal investing strategy is buying stocks that pay dividends, the 6 key investing tips presented below will work no matter which path you choose.

Watch Us On YouTube!

Investing Tip #1: Define Your Investment Criteria

The first important step for any investor is to define the investment criteria that are utilized for selecting stocks. By ensuring that solid rationale and reasons are in place for why certain stocks are being purchased, the investing process will have much more purpose and focus behind it.

If you have ever looked at a stock screener, one of the very first takeaways you will notice is that the screener can be overwhelming and confusing. There are a multitude of data points, information, and analysis presented as various filters. It can be difficult for expert investors, much less novice investors, to know where to begin finding stocks ripe for investment.

If an investor does not have set criteria in place for sorting and picking potential investments, it is far too easy to get lost in the “needle in a haystack” proposition.

Can investors be successful without having this criteria place?

Sure they can. But I would personally argue that success with such a strategy would be largely a result of blind luck rather than having a system in place for identifying investment criteria.

For instance, when I first began investing, I didn’t have any solid set of investment criteria in place. This led to investing in the markets because everybody else was doing it, or selecting stocks because a certain investor or two happened to own a position.

I saw firsthand how not having my own rationale for why these investments made sense for me lead to a lack of focus in my investing strategy, and eventually, loss of capital.

Since those early days, I have learned to differentiate between which strategies work for me and which ones do not. Over the years I have worked tirelessly to hone my own investing criteria, which mainly focuses on buying dividend-paying stocks that are trading at valuation points that are appealing to me and fit within my particular purchase points.

Below are the high-level criteria that I utilize on a daily basis when screening for stocks:

- 3%+ Div Yield

- $5B+ Market Cap

- Listed on a US Stock Exchange

- Price/Earnings (PE) Ratio Less than 20x

- Debt/Equity Ratio Less than 2x

- 15+ years consistent dividend payments

By developing these criteria, I find that I am able to much better focus on why I want to invest, where I want to invest, and how I choose to invest.

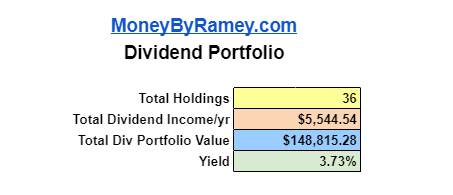

By systemizing my investing strategy, I have been able to build a dividend portfolio that now generates $5.5k+ in annual dividend income. This is entirely passive income which continues to grow year-over-year as I accumulate more shares via DRIP.

Interested in Learning The Dividend Investing Strategy?

I wrote Simple Investing: The Dividend Investing Strategy To Grow Your Passive Income for those individuals who are looking to deepen their understanding of dividend investing. Pick up your copy today and learn the ins and outs of how to properly invest in dividend stocks!

Investing Tip #2: Don’t Chase Yield

Although the investing tip number two of “Not Chasing Yield” applies mainly to dividend investors, the principle is beneficial to investors everywhere.

To begin with, we will look at how this tip particularly applies to dividend investors.

Being heavily involved in the dividend investing world, I follow many others in the dividend blogosphere.

A large majority of them have built up their portfolios through investing in solid companies, with a little bit of riskier plays sprinkled in here and there.

I would say the average yields on a solid dividend portfolio should be anywhere from 3-5%. At the time of this writing, my dividend portfolio yield is currently 3.73%.

However, there are some investors who disregard the inherent riskiness of the stock and only look at the higher dividend yield as their investment criteria. These investors execute what I call “chasing the yield” strategy.

For a long-term value investor such as myself, the last thing I want to get doing get caught doing is to chase a high yield in a high-risk company. This is because those stocks that pay a high dividend yield tend to be far riskier than various other dividend payers.

On high-yielding dividend-paying companies, a few things are usually happening:

- The share price is lower, possibly due to issues with the company or industry, or potentially due to macro events outside of the company’s control.

- While the share price is trending lower, the per-share dividend payout remains at the same, previously established level.

- If there is a deterioration of the company’s operations or industry, they could be trying to pay the previously justified dividend with lower earnings or cash flow. This is a recipe for the dividend being cut.

- If the above scenario presents itself, the company will then be faced with the issue of whether to:

- Cut the dividend.

- Take on debt or issue shares to continue supporting the dividend.

Now, the above actions do not always happen, but whenever an investor sees a very high dividend yield, due diligence should be completed to ensure the dividend is still being supported under current conditions.

A good rule of thumb is the higher the dividend yield, the higher the risk.

While this is not always the case, it is prudent for investors to consider the risk profile when deploying capital.

If you do happen to chase yield and get burned, make it into a learning experience. After all, our greatest losses can turn out to be our best education.

Real-Life “Chasing the Yield” Example

I was browsing Twitter one day when I saw someone who stated their portfolio was generating $20,000 in dividend income per year.

Intrigued, I clicked through to see what made up their portfolio.

I expected to see a $600,000 total portfolio value, which would be roughly a 3.3% yield.

However, I saw that the individual had a portfolio valued at $150,000, which equated to an astronomical 13.3% dividend yield!

Needless to say, this individual had very high-risk positions in their dividend portfolio. They were invested in a lot of sectors which, at one point been very successful, only to see their fortunes drop when the business climate turned against them.

Now, there is certainly a way to make a high-risk dividend investing strategy work, but it requires much more active portfolio management, trading, and not viewing stocks as pure ownership.

For me – and I would argue most investors – the ideal scenario is to buy adequately valued companies, with solid dividend yield, that we plan to hold for the long-term.

No matter which spectrum of the dividend investing strategy you utilize, ensure that you do not get caught simply chasing yield because it is a higher payout. It is almost a given that such high-risk investing will leave you broke in short order.

Investing Tip #3: Establish a Position Limit

I took away this investing tip from my time working at a commodity trading company. To ensure that traders were not taking an unrecoverable loss, the firm established position limits on any transactions.

Simply put, a position limit is an imposed limit on the size of anyone’s trade.

Thank you Rolf, Tim, and Bill

Position limits can come in many forms, but typically come in one of two arrangements:

- A max order size (i.e. only purchasing 1,000 shares at a time)

- A % base of total assets (i.e. one position cannot exceed 15% of a P&Ls total book)

As dividend investors, we can learn from this and incorporate this investing tip into our daily activity. I currently trade with self-imposed position limits, which help me to avoid ‘betting the farm’ should a particular investment be ill-timed.

Here are the position limits I have established for the MoneyByRamey.com dividend portfolio:

- No one position can exceed 15% of the total portfolio value.

- I trade in max $5,000 increments.

By maintaining these standards, I am better able to de-risk my portfolio.

Why 15%?

For instance, if company A is set at 15% of my overall portfolio value and subsequently cuts its dividend or declares bankruptcy, it is not a devastating hit to my portfolio, as I still have 85% of the portfolio intact.

I have plans to keep this position limit moving forward or, if anything, moving it lower to limiting positions to 10% to further reduce concentration risk.

Why $5,000?

The second position limit that I set on my trades is to ensure that I trade in $5,000 maximum increments. I find that this helps me to protect my downside in case I am incorrect in my trade assessment.

I will raise this level as the portfolio grows, but for now, I find that it is a good level to maintain.

Note that a strategy I utilize in unison with position limits is to buy a partial amount of a total that I’m looking to buy.

For instance, if I want to buy $5,000 of one stock, I might buy $3,000 on one day and save the remaining $2,000 purchase for a later date.

This is yet another way that I help to mitigate the portfolio risk of making one lump sum investment and having the markets move against me.

Investing Tip #4: Know Your Exit Point

When initiating a position, I recommend that each investor knows at what point they will exit that position. Note that this could be exiting a position after a certain level of gains are achieved or perhaps a certain level of losses.

For me as a dividend investor, my goal is to hold stocks indefinitely. This is because:

- When the stock is down, I get a chance to buy even more shares of that stock via DRIP. This results in massive share accumulation during depressed markets.

- When the stock is up, I gain from having the market valuing my shares higher. Hopefully, increase in share price is reflecting higher net income and cash flow through more product sales, which will help to further increase the dividend. .

In either case, the exit point for me is if the dividend is cut or eliminated altogether.

If the dividend happens to one of my stocks, it is certainly a sign that the stock needs to be re-evaluated and potentially removed from the dividend portfolio.

The key is to know what that exit strategy is and react when the point is triggered. Nothing hurts investors more than getting attached to a position, losing principal value, then selling at too low of a price point.

Investors Business Daily recommends that stocks should be sold when it loses 20% of its principal value. This way investors can react unemotionally to changes in the general market trends.

I personally like this principle but I do not always follow it. I am banking on the fact that I’m buying more shares at a lower price point and that the stocks I am buying into will eventually recover their value while maintaining or growing its dividend.

However, this is a double-edged sword, as I could be wrong, the company could cut its dividend, and therefore I’d take a ‘double-hit’ in the form of reduced dividend and depressed share price.

Thus when I’m implementing this strategy, I watch the stock very closely for any material deterioration in the company’s overall financial picture. If I see what seems to be a situation from which a company cannot recover, I will look to unload my shares into the market.

The main takeaway is to know what your exit point is and develop a strategy that you follow as a general principle.

Investing Tip #5: Track Cost Vs. Performance

With general investing, it is easy to calculate gains/losses. You enter the price you have paid for a stock and compare it to the overall gain or loss on the position.

When dividends enter the picture, it becomes much more difficult to assess how the stock is performing over the long-term. An investor now track the gain/loss on the actual position, the effect of dividends paid, whether cash is received or reinvested via DRIP, and a myriad of other factors.

For many reasons – namely tax reporting and performance metrics – it would behoove each investor to ensure that they start tracking their buy/sell from the beginning.

In my own dividend investing strategy, I ensure that I track the following metrics:

- Initial Purchase price or Sale Price

- Amount of Shares purchased

- Account where those shares are purchased in

- Total Sum of Initial purchases

- Total Value of the existing portfolio

- Overall Percentage Gain/Loss from Current Portfolio vs. Portfolio Cost

Once I have this information assembled, I have a great starting point for tracking the cost and performance of my portfolio. This is vital because in a dividend strategy, much of the gains will come from holding onto positions and acquiring more shares through DRIP or using the cash to purchase a new position.

No matter what strategy you use, develop a system for tracking the cost and the current value in order to capture the current performance of your positions.

Investing Tip #6: Know Your Investment Risk Spectrum

Last but not least, each investor should know and understand the investment risk spectrum.

What is the investment risk spectrum? Click through on that link to read the full explanation. To summarize, each investment lies on a spectrum of potential risk. At one end are high-risk investments, and at the other are relatively safe investments.

Investors can certainly invest on any point on the spectrum, but the following general rules would apply in doing so:

- Larger investments should be made towards the safer end of the spectrum.

- Smaller investments should be made towards the riskier end of the spectrum.

- While the larger investments are safer, they will typically offer less yield to an investor, but will have a better protection of principal.

- In contrast, since the smaller investments are riskier, the investor stands to gain much more upside from investing.

Thus, when looking at the risk investment spectrum, investors would be wise to make smaller initial investment amounts onto the riskier end while making larger initial investment into the safer, more secure end.

By knowing and executing on the risk spectrum on a daily basis, investors can better manage their portfolios and reduce downside risk!

While I came up with a list of 6 investing tips that work for me, I’d love to hear from you! Do you have any investing tips you’d like to add? If so, comment below and get the conversation started!

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Disclosure: I am/we are long $AAPL, $ADM, $BG, $BP, $BUD, $CALM, $CAT, $CMI, $CTL, $DAL, $F, $FAST, $GE, $GT, $JNJ, $IBM, $INGR, $KHC, $KO, $KSS, $MMM, $NWL, $PFE, $PG, $SBUX, $SJM, $SPTN, $STX, $T, $TSN, $UPS, $WFC, $WPC, $WRK, $WY, $XOM

Disclaimer:(1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!