A Dividend Cut was Announced: What Should I Do?

A dividend cut was announced: what should I do!?! As an investor, one of the things we never want to see is deterioration in the companies we own, especially a dividend cut. Should you take this as an immediate sell indicator, or is there more to the story? Read on to get my take.

The Dividend Investing Strategy

I have been executing the dividend investing strategy for 10+ years. It all began when I became disillusioned with the age-old idea of building up a large stock portfolio only to piecemeal sell it down the road when I retired.

Rather than selling my assets to sustain my lifestyle, I thought there had to be a better way. Thus my foray into dividend investing.

The heart of the dividend investing strategy is simple: build up a solid portfolio of stocks that generate income through dividend payments. It requires that would-be investors buy up great companies whenever a value proposition presents itself. Repeat this over and over, year-after-year, and eventually, you have a good steady stream of dividend income.

This has worked very well in my own life, where I have built up a dividend portfolio that is currently generating $6,700/yr.+ in passive dividend income. However, it has not been without its hurdles. Macroeconomic events can negatively affect those companies that pay a steady dividend.

Enter 2020 and the rise of the Covid19 (Coronavirus).

Coronavirus: The “Black Swan” Causing Dividend Cuts

The coronavirus pandemic has shown investors all over the world that a Black Swan event can occur at any time and wreak absolute havoc in the market.

Nowhere has this been more apparent than in the realm of dividend investing. This is because dividends that a company pays to its owners is a highly elective payment. The company chooses to pay a dividend to entice and reward shareholders. Unlike debt payments, in which a company is obligated to repay debt-holders or face legal repercussions, the company is under no obligation to continue making a dividend payment (unless it is preferred shares, which act similar to a debt obligation).

For the dividend investor, a black swan event can be a very challenging time as one of the first items to be cut if a company falls on tough times is the dividend payment to common shareholders. Not only has the share price gone down in most cases, but the company has now stopped the dividend payment. It is a double dose of bad news.

So what is a dividend investor to do when its dividend is cut? There are a few different ways an investor can deal with the dividend cut.

A Dividend Cut: The Investor’s Nightmare

One of the worst things that can happen to a dividend investor is to have a dividend cut in a company which they are holding an equity position.

This is because the entire foundation of a dividend investing strategy is to buy into various entities that, as a core principle, agree to pay a steady dividend to the shareholders of the company. The main goal is to be able to have a dividend portfolio that pays a steady income which is entirely passive in nature.

However, if a company decides to suspend the dividend payment through a dividend cut, the dividend investing strategy is essentially ‘nuked’ and one now holds the stock from a speculative growth perspective.

Dividend Cut: To Sell or Not to Sell?

One of the first questions that investors might ask themselves after seeing a dividend cut is whether they should keep holding on to the company or whether they should sell that security before things get worse.

If you would have asked me this question two years ago, my answer would have been to definitely sell the stock. That’s because I perceived that the situation would only be looking to get worse rather than better and that it made good sense to get out of the position.

While there is merit to this line of thinking, I currently do not maintain the ‘sell immediately’ mindset whenever I see a dividend cut. Rather, I like to take a step back to understand if it is a long-term or short-term indicator.

Now that I’m experiencing a situation where a few stocks in my dividend portfolio have suspended their dividend (KSS, GT, BUD, F, DAL), I am in a much different mindset then selling. That’s because, I’ve grown to appreciate and enjoy owning these stocks, especially for the fact that I do routinely use their products and that they are great overall companies.

I’m also of the mindset that the current coronavirus crisis that the world is facing will be short-term in nature. There are already many reports of the global workforce beginning to go back to work as usual. While we are definitely in for a rough next few quarters, I do believe that things will return to the sense of normalcy quicker than many individuals have anticipated.

So When Should I Sell the Dividend Cut?

So if I’m not selling on a dividend cut immediately, when would I sell? The answer for me really lies in the underlying fundamentals of the stock. If the dividend cut was due to the company no longer having a viable business model, that to me is a much more dire situation than global macroeconomic events turning against the company.

What I’m seeing in the current situation is that many solid companies are closing their factories, storefronts, and businesses temporarily until the coronavirus situation is under control. While there is still high risk associated with such a situation, the closings do not have anything to do with a decline in fundamentals but rather global macro events.

The overall risk is not due to any of these company’s own deteriorations, but rather due to worldwide events outside of their control. As a dividend investor, so long as the fundamentals are staying into place I want to continue holding on to these companies long-term.

What do I mean by fundamentals? I mean the financial metrics against which every company is measured. This means things like:

- Debt/Equity

- Price/Earnings

- EBITDA/Interest Expense

- Cash Flow From Operations

- Dividend Payout Ratio

This means that we need to do more research after a company cuts its dividend.

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Do a Quick Deep Dive After a Dividend Cut

As investors, we can only know if the fundamentals are still in place if we engage in the due diligence required to understand this. What this means is that what a stock does cut its dividend, it is our prerogative to look at the situation and answer the reasons why.

That means that we pour ourselves a cup of coffee, cozy up on the couch or office chair, and pull up the latest 10K or 10Q as it is time to crunch some numbers.

In the deep dive due diligence phase, we want to ask ourselves questions such as:

- How is the company’s cash flow? Does it cover the dividend? Is it positive and stable/growing?

- Is the company increasing its revenues and bottom line?

- Are the current debt levels sustainable?

- Is a company picking up customers or are they losing customers?

- Is top management following through on their promises?

- What are the future prospects for this company? Is the company in an industry that is on the upswing?

Keep in mind this list of questions is not all-inclusive but does provide a good starting point for any investor.

International Shipholding Company ($ISH): The Dividend Cut

Case in point: when I first started out investing many moons ago, I owned International Shipholding Corporation ($ISH). The stock performed well for a time, but it eventually cut its dividend after a year of me owning it.

Once the dividend cut took place, I asked myself whether or not it was due to macroeconomic events or if it was due to the fundamentals of the company.

What I personally discovered was that, in addition to a decline in the industry, I saw the fundamentals of the company deteriorating as well. Being that was the case, I made the decision that this was not a company that I wanted to hold on to long-term, but rather one that I’m headed for potential bankruptcy.

I ended up selling the stock and though it made a few gains after I sold it, it did eventually declare bankruptcy.

My lessons learned were twofold:

- Smaller market caps have much more trouble sustaining their dividend through difficult circumstances.

- If the dividend is cut, it is time to re-analyze to figure out if the stock is still worth owning.

Quick Decisions Save Dollars

If your stock ends up cutting its dividend, make sure to complete your due diligence, but also trust your instincts. If everything inside of you is telling you that this is a solid company, that is an indicator that it might be a stock to hold onto for the long term. However, if your gut is telling you that this dividend cut is just in fact the beginning of the end, then that is definitely a time where you need to strongly consider selling.

The best course of action is to make that quick decision and stick to it. I find that investors sustain the greatest losses when they either make decisions that are hurried without proper due diligence or when they delay decisions that they know to be right.

If your company ends up cutting its dividend, ensure that you are making a quick decision on what to do next.

5 Ways to Make a Dividend Cut Less Painful

So your company has announced that it is going through a dividend cut or dividend suspension and there is nothing that you can do about it. What can investors do to avoid or protect themselves from the pain of a dividend cut?

#1 – Diversify Your Asset Portfolio

The number one thing that investors can do to protect themselves from a dividend cut is to ensure that their portfolio of assets is well-diversified. Here I’m not only talking about stocks owned inside of an investment portfolio, but rather the diversification of their entire asset base.

Diversification of the Investment and Asset Portfolio

Within the investment portfolio, it is important to own a wide variety of stocks in a wide variety of industries so that the positions will be diversified enough should the market head south.

This is because if one certain company or one certain industry is struggling, another company in a different industry that is doing better will offset the challenges faced by the down stocks in your portfolio.

I’ve seen it time and time again where a subset of my stocks is trending downwards while another set of stocks is trending upwards. Such is the nature of Mr. Market. Granted this opposite correlation is not always the case, but by diversifying, I am able to help protect and hedge the downside and thus improve the risk management of my portfolio.

The other element of diversification is to own assets outside of a dividend or investment portfolio. This means owning assets outside of stocks.

These other assets could be:

- Real Estate

- RE investing platforms, such as Fundrise

- Direct Lending, such as Prosper

- Cryptocurrencies

- Physical Assets (commodities and products)

The main element to being properly diversified is not to have overexposure to any one type of asset class or stock. I personally have the guide of limiting individual stocks in my dividend portfolio to 15% or less of any one individual stock. I’m also working on diversifying into other asset classes besides the stock market.

By achieving this level of diversification, we can see that while a dividend cut in our favorite stock hurts, it won’t tank our entire portfolio. Rather we will have other assets there to pick up the proverbial slack.

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

#2 – Own Quality Stocks and Brands

Another way to avoid the pain of a dividend cut is to own quality stocks which are much less likely to cut their dividends. It is interesting to note that during this coronavirus epidemic, while various stocks were canceling or suspending their dividend, other stocks such as Procter and Gamble ($PG) and Johnson and Johnson ($JNJ) actually increased their dividends paid to stockholders.

Both of these companies have quality brand names, quality operations, and products that can withstand a downturn in the markets better than most of the other companies that are publicly traded.

This gets into the notion that as dividend investors, we should keep our eye on the prize of owning stocks with reliable cash flows, low levels of debt, and sustainable payout ratios. So long as we are practicing this type of sound investment philosophy, we are going to own quality companies that will continue to increase their dividends during difficult times rather than doing a dividend cut or suspension.

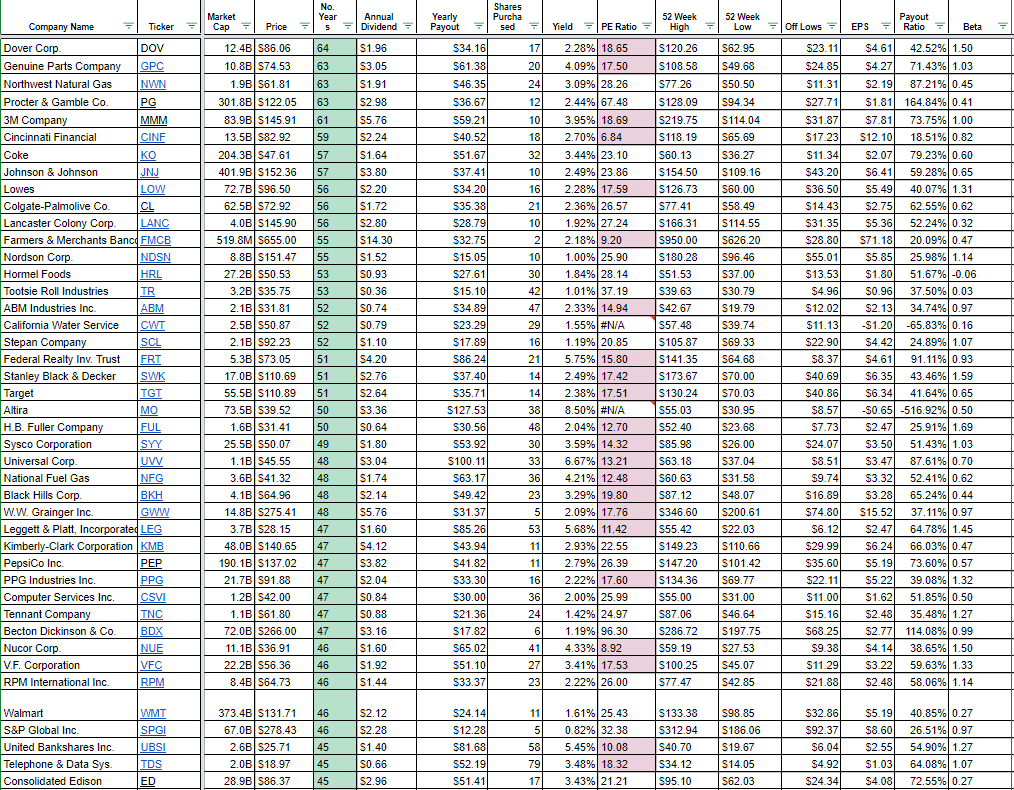

Here is an excerpt from the MoneyByRamey.com Dividend Watchlist on companies that have been paying dividends for 45+ years or more:

#3 – Keep the Long-Term in Mind

Another way that investors can keep their portfolios intact and avoid the pain of a dividend cut is to keep the long-term picture in mind. Though we want to take our stocks through the due diligence process during challenging times, especially if a company does end up cutting its dividend, we want to be wise and not overreact to short-term fluctuations.

This gets to the heart of the main principle of the “buy-and-hold-forever” investor, who sees owning company stock not as blips on a screen but rather as absolute ownership in the companies he or she is invested in.

By keeping the long-term in mind, we can truly begin to ascertain whether or not a dividend cut is something that is a sign of things to come or a temporary situation in the companies that we own.

While I never want to see a company cut its dividend, I want to view the dividend cut in the lens of macro, long-term thinking. This means that a company I own like Delta, who recently suspended its dividend because the world stopped flying in order to contain the Coronavirus, needs to be reviewed in the lens of the long-term viability of the company.

This means that I ask myself the questions, “Is this still a well-run company with solid fundamentals, in a good sector?” There is no doubt that it is going through massive pain right now, but should the company make it out of this situation, will it be stronger on the other side?

Delta is a company that, when I consider the long-term view, I do still want to own it for many years to come. Even though airlines are going through some very challenging times right now, I believe that things will turn around quicker than many have anticipated.

Believing that it is a well run company with good overall fundamentals, I am bullish on the long-term overall outlook. Eventually, it is my hope that Delta will continue to prosper in the future and once again bring back its suspended dividend.

#4 – Layer Your Purchases

Another way that investors can protect themselves from a dividend cut is the investing concept that I refer to as “layering investments”. What this means is that rather than take larger, one-time positions, investors are better off to invest in smaller, more frequent amounts.

By doing so, investors are able to gain from the principle of dollar cost averaging, in which they are buying in on a consistent basis, both at the tops and bottoms of the market, thus achieving an average price of ownership throughout the lifetime of the stock.

I currently have a personal limit on any one-time position right around $5,000. This is because I realize that I buy when valuations present themselves and this is a long-term strategy. I’m not out to take a large position, gain a quick increase, and sell in short-order. Therefore, it benefits me to make smaller, more consistent purchases over my lifetime than one, large ‘home run’ type purchase.

If I do choose to invest a large beginning amount and I’m confident of my position of the due diligence behind it, I will look to “layer purchase” in a down market. That might mean that I would buy an extra $500 here, or perhaps an extra $1,000 there, and continue to make purchases so long as I consider the value of the stock still in place. Remember, there needs to be solid fundamentals behind the stock, not just blind faith in the company as a whole.

By practicing layering investing, investors can protect their portfolio against volatile negative market swings. Should they invest in smaller increments, the investor will have a better ability to step back as time goes on and view the market movements as they are happening. The main benefit of layering is that he or she would have more flexibility to determine where the markets are at and the next direction they need to take with their money.

#5 – Own Forever Products

Lastly, I find it very important to own companies that produce forever products. What are forever products? I define these as products that I see lasting throughout my lifetime and beyond.

Now, I’m a big proponent of innovation, and I’m always excited to see the latest and greatest in product development. Whenever a new product is brought to market, it is only natural that there will be a disruption. Obsolete products will experience a decline while the new product replaces the old. We’ve seen this time and time again in regards to new technologies (i.e. cell phones replacing landlines, tablets replacing paper, iPods replacing Walkman/CDs, etc.).

But despite the new technologies, I do believe that there are certain products that will be around for quite a long time – forever, in fact.

Here are a few examples of companies that I see producing forever products:

- Coke (KO) – Everyone loves a good Coke from time-to-time. The key is in the formula, which Coke controls and cannot be copied.

- Starbucks (SBUX) – Nearly everyone loves a good cup of Joe and the experience of a Starbucks coffee shop.

- Procter & Gamble (PG) – Consumer staples products that companies like PG produce will never go away. Individuals will always want clean clothes (Tide), dishes (Dawn), Toilet Paper (Charmin) and many more.

Now, this doesn’t mean that the companies will always exist in their current form. They must maintain solid management and physical discipline in order to continue moving forward in the corporate life span. Innovations, acquisitions, and growing the customer are all part of the future success.

However, great products combined with amazing brand recognition makes it very challenging if not impossible to duplicate these companies success. Each of these companies has a corporate “moat” and I see them sticking around for the long term.

Summary: Be Wise Regarding that Dividend Cut

By being wise investors, we can see a dividend cut as an event that doesn’t necessarily mean that we have to sell the great company that we own.

It would benefit us to utilize our long-range thinking to complete a thorough due diligence analysis, and really get at the heart of whether this is an issue with the fundamentals of the company or is this dividend cut a short-term blip in an otherwise great company.

Once we answer this question, we can then be ready to figure out what we need to do next. And if we do decide to sell the company due to the dividend cut, but practicing the tools of being properly diversified in both assets and investments, we can make a dividend cut much less painful.

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CAG $CAT $CLX $CMI $COF $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LUMN $MMM $MSFT $NWL $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $T $TSN $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!

Hello Matt,

I’m a german so my english is not the best …. this is one of the first comments on a website outside from Germany ….. I am also a Dividend investor and wish you all the best … great blog … I come back …

Thanks a lot for the inspiration

Yours sincerelly

Uwe

You have great English! And I love that dividends expands beyond countries and that we can reach up on each other’s sites. Thanks for stopping by and good luck to you as well! -Ramey