The Money By Ramey Portfolio: February 2021

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio February 2021 Update:

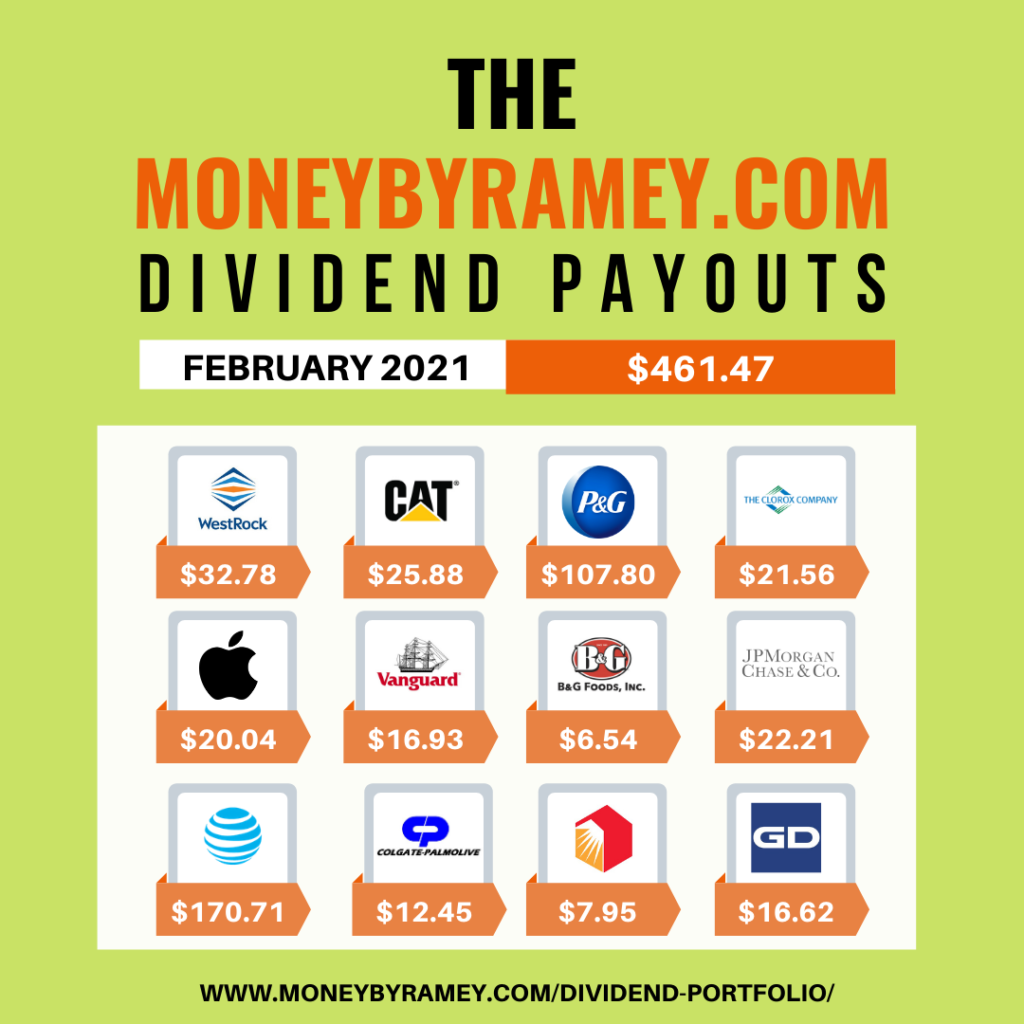

MoneyByRamey.com February 2021 Dividends

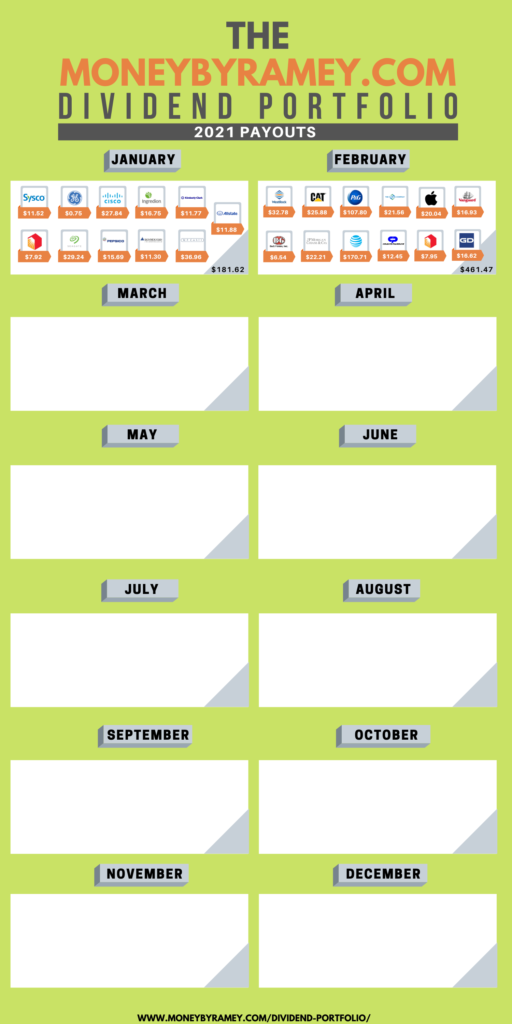

MoneyByRamey.com Dividends 2021

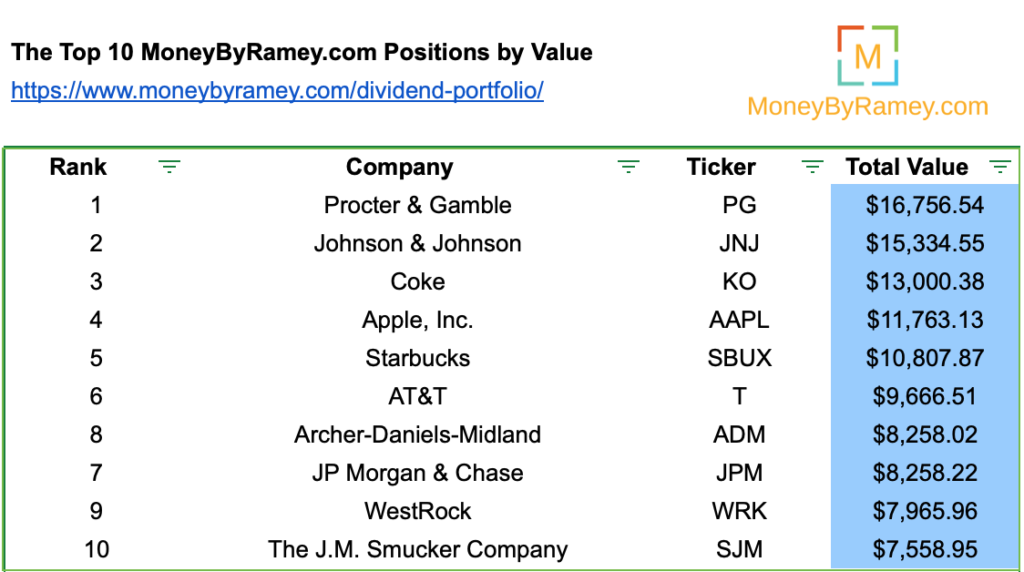

February 2021 Top 10 Stocks by Value

In February, I began to add more positions in Coke, Johnson & Johnson, and General Dynamics. Though $GD didn’t make this list, it is certainly increasing in overall value. Will $JNJ overtake $PG to top off this list? Time will tell.

Will I be adding to any of these positions in 2021? Perhaps – I’m always on the lookout for the next best stocks on the MoneyByRamey Dividend Stocks Watchlist.

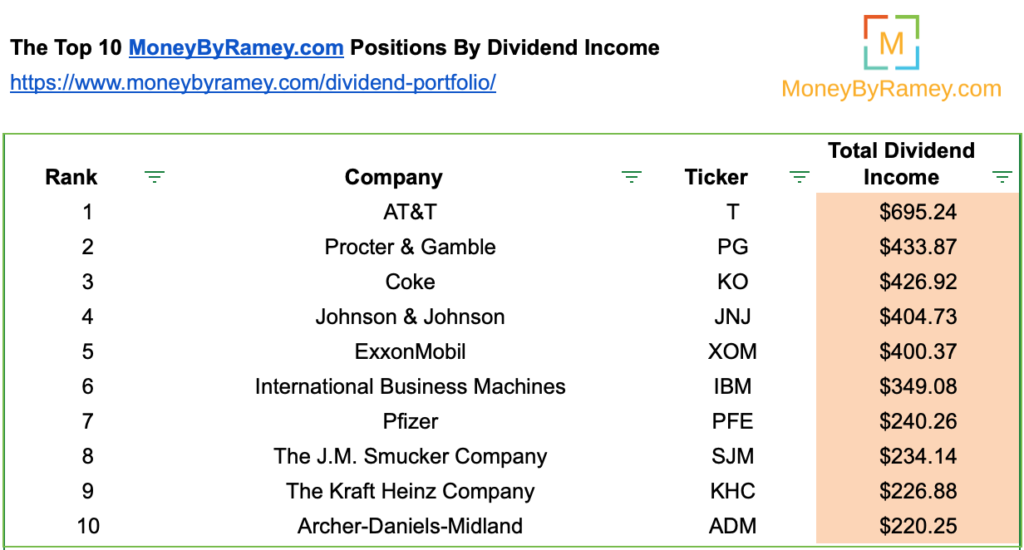

February 2021 Top 10 Stocks by Dividend Income

$T still rounds out the top 5 for our dividend positions by dividend income. Fueled by solid cash flow, it is hopeful that this stock can continue to perform well into 2021 and beyond. There is some concern that the company did not increase its dividend as expected in 2020, but MBR continues to be bullish on this company and its future prospects.

$PG is the stellar-star performer, being #1 for value and #2 for dividend income. This shows that consumer staples is still a solid sector to be involved in.

$KO shot up into the #3 spot after I picked up more shares to hold my cash reserves.

$JNJ is a great performer as well and we continue to layer in more purchases of this stock in the months to come.

$XOM is #5 and I’ve been surprised to see the value of the stock go up so much. It will be interesting to see this stock’s trajectory in the years to come as the US is actively looking to phase out fossil fuels.

Check out the full MoneyByRamey.com portfolio here.

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CAG $CAT $CLX $CMI $COF $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LUMN $MMM $MSFT $NWL $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $T $TSN $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!

Your portfolio looks great, and amazing on how you are growing your dividend portfolio.

Have you thought of buying some growth stocks , then once they profit , use the growth and place into dividend paying stocks.

A few of my favorite are $NIO, $XPENG, $TESLA,

Hi Darryl, thanks for the comment! Yes, I like your thinking. I do own stocks above and beyond my dividend portfolio, though my focus is really on dividend-generating companies. My strategy is to never sell a share of stock in any company that I own and then eventually have a steady stream of income that I ‘turn on’ by changing from DRIP to cash. Until then, I’m buying up more stock through DRIP. You’ll notice though that I have positions in $AAPL & $MSFT, which pay a small dividend, but really is a play for me to be more in growth stocks.