The MoneyByRamey.com Top 3 Dividend Holdings

This post was originally featured on Dividendstocks.cash, where we are thankful to be listed as a ‘dividend income hero‘.

Hello to all the dividend investors out there! My name is Matt Ramey, and I am the owner and operator of MoneyByRamey.com.

The MBR goal is to teach Financial Freedom to the Universe, and we do this by building up our passive income sources. One of the best ways that I know how to build a passive income is to invest in stocks that pay dividends.

For the past 15 plus years, I have been working on improving my acumen in the dividend investing sector and honing my very own dividend investing strategy. The results have been astounding.

As of this writing, my yearly dividend income equals $5,653.77 across 36 total positions, which continues to be reinvested into the position that I own through a DRIP program. My own goal is to have a portfolio that generates $50,000 of dividend income per year, and one that I can use to retire and live upon.

Today, I am going to show you the top three holdings in my dividend portfolio as filtered by annual dividend income. I will give you the reasons why I hold these particular stocks in my portfolio as well as if I’m looking at buying into these companies at this time.

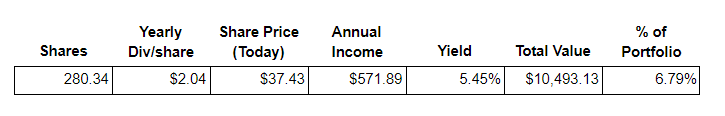

AT&T ($T)

Ownership Summary

I consider AT&T as one of the stable dividend stocks in my dividend portfolio. Not only is this stock one that distributes the most annual dividend income, but it is also one of the stocks that I am accumulating more and more shares via a relatively lower share price. The higher dividend yield and share accumulation are big reasons why I like this stock.

3 Reasons Why I Like this Stock

1. Sheer Size of Customer Base

AT&T is gigantic. With a customer base of 370 million users, it’s no surprise that many individuals and companies utilize its services on a daily basis. With its purchase of Time Warner, AT&T is attempting to capitalize on its vast customer base by improving its content offerings over the coming years ahead. Considering that “Content is King” these days, I am excited for the future prospects of AT&T continuing to create great content and to continue sharing that with its customer base.

2. Great Dividend + Share Accumulation

Currently, I am receiving some excellent dividends from AT&T as its stock still remains lower-priced, mainly because of overall debt concerns.

The acquisition of Time Warner brought with it a very large debt load, which has been depressing the AT&T share price during the past few years. Some investors question the integration strategy as well as the ability of the company to continue paying down its debt.

Personally, I am a believer in the AT&T story, specifically in the fact that they can continue to increase their presence in the content world while generating the same consistent cash flows to pay down its debt at an adequate rate.

In fact, I welcome the lower share price. The current depressed share price has allowed me to accumulate around an extra 15 shares per year via DRIP.

See the MoneyByRamey.com Dividend Calculator

3. Great Cash Flow

Each company that I choose to invest in needs great cash flows. AT&T fits the bill:

Last 5 Years (2014-2018)

Last 5 Quarters (June 2018 – June 2019)

Buy/Wait?

At these price points, I still believe that AT&T is well valued for investment. The company continues to generate good cash flow needed to pay down it’s massive debt while making inroads into the content industry.

Even though the stock has been going up recently due to Elliott Management’s involvement in the company, I would be open to picking up more shares at current levels.

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

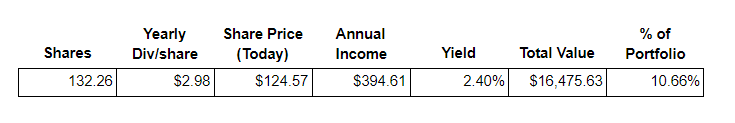

Procter & Gamble

Ownership Summary

Procter & Gamble is a stock that I added into the portfolio a little over a year ago. Since then the share price has absolutely taken off as many investors have been looking to expand into defensive type holding such as consumer staples stocks. At this present time, P&G makes up the highest valued position in my portfolio and the second-highest from in annual dividend income.

Why I like this stock

1. Consumer Staples Stocks are in Demand

As discussed in the Procter & Gamble introduction, it is a stock that is defensive in nature. Whenever investors begin to fear issues in the general markets, namely the chance of a recession happening, they tend to look for safe spots in the market.

At those times, they tend to gravitate towards consumer staple stocks or companies that have repeatable purchases. The fact that P&G has been able to gain market share by increasing its prices is certainly a trend that an investor such as myself likes to see. This goes to show the excellent brand names that exist in the P&G family.

2. Repeatable Business Model with Excellent Brand Names

Even though the products that P&G are not sexy in nature, the fact that consumers purchase these products on a routine and repeatable basis is the stuff that great companies are made of.

Products like Tide, Dish soap, and Crest toothpaste resonate with customers and keep them coming back for more. That’s a company I will own now and into the future.

This type of staying power is allowing me to accumulate roughly 3 extra shares of PG each year via DRIP investing.

3. Great Cash Flows

Each company that I choose to invest in needs great cash flows. PG fits the bill:

Last 5 Years (2014-2018)

Last 5 Quarters (June 2018 – June 2019)

Buy/Wait?

At this current time, I’m not directly buying anymore PG as I believe that the stock is overvalued relative to the current dividend yield. I do believe that the company is a solid operator and I would love to own more of this company, it’s just that I see better values out there and different companies at this present time.

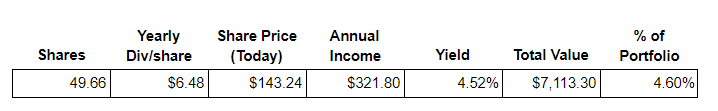

IBM

Ownership Summary

IBM is an interesting company that I am holding at the moment; I bought into the company after Buffett sold out of his position and called his investment in the company a mistake.

It seems as though IBM lags behind other tech giants out there, such as Amazon, Apple, Microsoft, etc., though this is simply in perception. IBM is still a monster tech company in other areas. In fact, the company seems to be more of a “behind the scenes” tech giant, one in which everyday individuals do not directly see the benefits in the world around them. I would argue that much of the tech IBM is developing will not be felt for many years to come.

Why I like this stock

1. Blockchain

One of the main reasons why I want to be holding IBM right now is for their interest and development of blockchain technology. While I do not own any Bitcoin, I do see the power and the benefit behind not only the cryptocurrency itself, but the blockchain technology upon which the cryptocurrency is built.

I believe that in 10 or 15 years time, blockchain technology will be utilized in many different business functions across the world. When that time comes, I am hopeful that IBM will be a company that is on the cutting edge of building out those technologies.

2. Other Technologies

Being a technology enthusiast, I am excited about all the different sectors and initiatives that IBM is undertaking. In addition to their big move into blockchain, I am also very excited about the following sectors:

- Cloud-based services, especially around the Red Hat acquisition

- Nanotechnology

- Quantum-Safe Cryptography

All of this great technology has produced repeatable cash flows, which has allowed me to continue increasing my forward dividend income by roughly 2 shares per year:

3. Great Cash Flows

Each company that I choose to invest in needs great cash flows. IBM fits the bill:

Last 5 Years (2014-2018)

Last 5 Quarters (June 2018 – June 2019)

Buy/Wait?

At this present moment, I have no plans to add any more shares of IBM. I am happy with my current exposure, and I would like to see how the company integrates its $34B purchase of Red Hat into its existing operations. If the company’s shares remain at the same level or trend downwards, I might be inclined to pick up some more ownership, so long as the company is trending in a positive direction with debt repayment and cloud-based services.

Summary

These are the current top 3 holdings in my portfolio by annual dividend income. The portfolio does have 33 other stocks that are paying me dividends on a routine basis. For more insight into the other positions, visit MoneyByRamey.com today and see how the dividends continue to grow!