The Power of Reinvestment Plan

One of the most powerful paths to Financial Freedom is owning dividend-paying stocks on a Dividend Reinvestment Plan (or DRIP investing) for short.

DRIP is an acronym that stands for a Dividend Reinvestment Plan. These DRIPs are offered by most companies and are available through any reputable brokerage firm.

So why is a Dividend Reinvestment Plan (i.e. DRIP investing) so powerful? Two words: share accumulation.

The principle is simple: when you receive a dividend payment, rather than accept the dividend as cash in your account, you direct the brokerage firm to take that dividend. And use it to buy more shares of the particular company. Each time the company you are investing in pays a steady and consistent dividend, your ownership position increases.

Additionally, each time the company raises its dividend, you buy even more company stock. You buy up whatever dollar value is available through your dividend, most often being fractional ownership positions in your dividend payers.

The result? Ongoing and increasing ownership positions through share accumulation.

Share Accumulation (aka The Snowball Effect)

It is through this repurchasing of additional shares that we accumulate even more company stock which provides for runaway investment growth.

While we make an initial cash outlay to purchase the stock, we will continue to build and grow more and more dividends through DRIP investing.

This type of growth is often referred to as the “The Snowball Effect” of dividend investing.

Picture if you will a snowball heading down a hill. It may not be very big at first, but as it rolls down the hill, more and more snow is added to it. And its size grows larger and larger.

Once small, it now adds onto itself as it accumulates more and more snow. The result? A snowball that is hundreds and thousands of times bigger than the initial size.

This same principle holds true when adhering to a Dividend Reinvestment Plan with our dividend stocks; our positions keep growing larger and larger each time a company pays a dividend with our positions on DRIP.

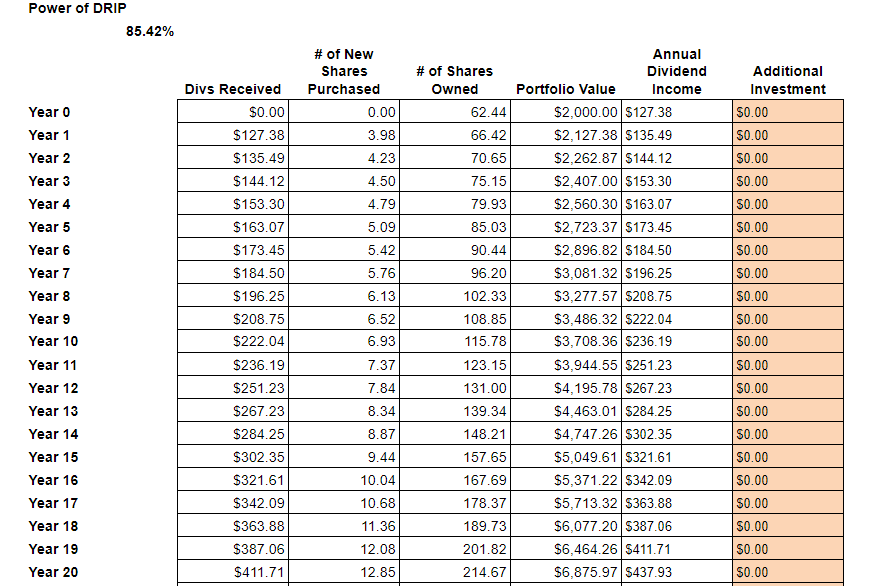

Consider the following example. Assume that you invest an initial $2,000 into $T at an initial price of $32.03. Here are the one year numbers:

Assuming we have AT&T on a Dividend Reinvestment Plan, we see that our investment more than doubles over a 20 year time period:

Not bad right?

Well, consider what happens if we add more and more to our initial position.

If we continue to invest $1k each year for 4 yrs after our initial investment, the return on investment goes from a solid 85% to an amazing 135%! You also grow your dividend income to a respectable $1,190.31 over a 20 year time period, all for $6k in total investments.

Now, this model makes the assumption that share price remains the same, as does the dividend payment. Keep in mind that many things will change over the long-term, so these numbers will certainly be different.

This example is merely to show how powerful DRIP Investing can truly be; this is the 'snowball' effect in action!

Benefits of a Dividend Reinvestment Plan (DRIP Investing)

The benefits of DRIP investing are many. For everyday investors, it is the surest and simplest way towards successful implementation of a dividend investing strategy.

Emotion Control

First off, the DRIP model helps control investor emotions. I will be the first to admit that one of the hardest things for me to do as an investor is to watch stocks in my portfolio go into negative territory.

Seeing "the red" on the financial screener can be disheartening as, even though these are ‘paper’ losses, the loss is still real if I were to liquidate today.

However, to a dividend investor with positions on DRIP, we can hold fast. Since we have completed the proper due diligence on the front end and are assured that our analysis is correct, we can begin to see lower stock prices as a benefit and not as a drawback.

Why is this?

It is because Mr. Market is now undervaluing a solid dividend-paying stock. Through DRIP, we now get to purchase even more shares because of lower prices, all thanks to the erratic tendencies of the market as a whole.

Since we view our stock positions as ownership in some of the best companies the world over, we can have a relative ‘set it and forget it’ mentality when investing in strong companies on DRIP.

While others are frantically selling or wondering how to protect capital appreciation, we can rest assured that our income will be intact. In most instances, market downturns can actually be the investor's best friend.

Dollar-Cost Averaging

Another great benefit of having a dividend reinvestment plan set up is it is a form of dollar-cost averaging. Instead of needing to review stocks on a routine basis for when to deploy our new capital, we now have our dividends being redeployed in a regular manner across all of our positions.

This helps alleviate the need to ‘time the market' or consistently find new values. It also helps us continually build up our positions in some great companies at various prices.

Some investors may want to receive dividends as cash and redeploy into new positions as their research shows better value plays. While there is merit to this line of thinking as we will know exactly when and how our dividends will be deployed, I remain a big fan of dollar-cost averaging mainly due to it removing the need to make decisions.

For me, not only is having my positions on DRIP a form of dollar-cost averaging, but it is also a way to avoid decision fatigue.

Let me explain.

Each time we make a decision, it takes a bit of our mind power away from us. Studies have shown that as human beings, we wake up with more will power in the morning. But as we make more and more decisions throughout the day, our will power becomes eroded as we begin to experience decision fatigue.

This is cited as a primary reason why you see many Silicon Valley tycoons, mainly the late-great Steve Jobs, as always wearing the same outfit - a black turtleneck with blue jeans. By wearing the same outfit daily, he removed an aspect of decision fatigue from his daily schedule, which opened him up to more will power for the bigger decisions that would come up later that day.

By having our positions on DRIP, we will not need to constantly research new stocks whenever we receive a cash dividend. This will help to maintain our will power at higher levels. The result?

Our overall stress level and decision-making abilities will be greatly improved. Whether or not you choose DRIP on some or all of your positions, know the pros/cons of removing decision fatigue from your daily lifestyle.

Stocks on Auto-Pilot

Another great benefit of DRIP investing is that your investment positions are on auto-pilot. As an investor, it takes a lot of energy finding, researching, and initiating new positions. Often times, a part-time investor doesn’t have enough time in the day to properly manage an investment portfolio like a full-time investor.

I have found that dividend investing is a great way to keep investing into the market without having to continually initiate new positions in the marketplace. While I do continue to monitor my stocks for performance, the majority of my research is done at the beginning of investing into a stock. Monitoring a position takes far less effort than does initiating a position, especially when buying in for the first time.

DRIP Investing takes little-no effort on my part. This type of auto-pilot mode for my stocks, where I am investing at routine intervals, is another great benefit of DRIP investing.

Consistent Raises Will Keep You Motivated

There are two main ways that you will get raises via DRIP Investing:

- Buying more shares via DRIP.

- The company raises its dividend payment.

Both of these are fantastic ways to increase your ownership positions. In fact, I find that for many of my stocks, I am accumulating more shares through DRIP. And the companies have a policy of raising the dividend payment once per year.

In Dividend Income: the Trend, I track this growth. As you can see by looking at this data, I am increasing my annual dividend income, both through DRIP and raises. It’s a fantastic win-win proposition.

A Word of Caution on Dividend Reinvestment Plans: Stay Diligent

As investors seeking Financial Freedom, we want to simplify our lives through generating income that is passive in nature. One of the best ways that I have found to do this is through dividend investing - in particular through DRIP investing my current positions. However, if we do pursue this avenue of passive income, we need to stay diligent.

Being someone that seeks out value plays in the investment world, I am cognizant that there are reason why certain stocks are valued lower than the general market. In most cases, there are the following factors at play:

- Growth has hit a wall and revenues are stable or declining.

- Technology is disrupting the industry as a whole and the company is having challenges in adapting.

- Consumer tastes are changing and the company’s products might not be in demand.

As dividend investors, we must trust in our initial outlay. But remain cognizant that the stocks that make up our portfolio need to be monitored on a consistent basis for material declines in operations.

If a stock cuts its dividend, struggles with cash flow, or the industry is under challenge from outside pressures, it might be time to sell our position and focus on greener pastures.

The main theme is to stay diligent with our dividend investing. And in particular with stocks on a DRIP investing plan, to ensure that our positions are still on good footing.

Want to improve your dividend investing and money management skills? Sign up for our Live Free and Div Hard email list to receive the latest updates and articles straight to your inbox!

_____________________________________

Do you invest in dividend stocks? Do you have your stocks on a Dividend Reinvestment Plan? Why or why not? Get the conversation started below!