10 Reasons Why I Welcome A Market Downturn

The market downturn is the natural condition of the greatest invention of all time; the modern-day stock market.

As individuals who deploy their capital into the markets, we must change our mindset from seeing the bits and bytes that go up and down during market upheavals as more than just numbers on a screen.

Rather, each one of our stock positions represents actual ownership in the company that we are investing in.

It is my belief that once we change our mindsets and truly start understanding that we are owners on a daily basis, our investing will go to the next level.

So why should an investor welcome market downturns? In this post, we will explore 10 reasons why not paying attention to market downturns can be good for you and your portfolio.

#1 Dollar Cost Averaging

The very first reason why investors should welcome market downturns is the concept of dollar-cost averaging.

Dollar-cost averaging, or DCA for short, is the investment principle that if investors continue to deploy capital in the markets at steady intervals, they will achieve an average mean of both high prices and low prices. The idea is that an average is achieved over the lifetime of an investor.

The biggest advantage to this strategy is that the investor is able to adopt a “set-it-and-forget-it” mentality towards investing.

The basic idea behind DCA is that one day, many years from now, after steady and consistent effort, the investor can look at their portfolio and realize that they have accumulated a wall-sized position of both stocks and bonds.

The dividend investing strategy is perfectly suited for individuals to adopt this particular methodology of investing.

While the initial leg work research required in buying dividend-paying stocks can be extensive, the benefits of doing so are readily apparent in the long run in the form of compounding positions through reinvesting dividends and in lower overall fees on one’s portfolio.

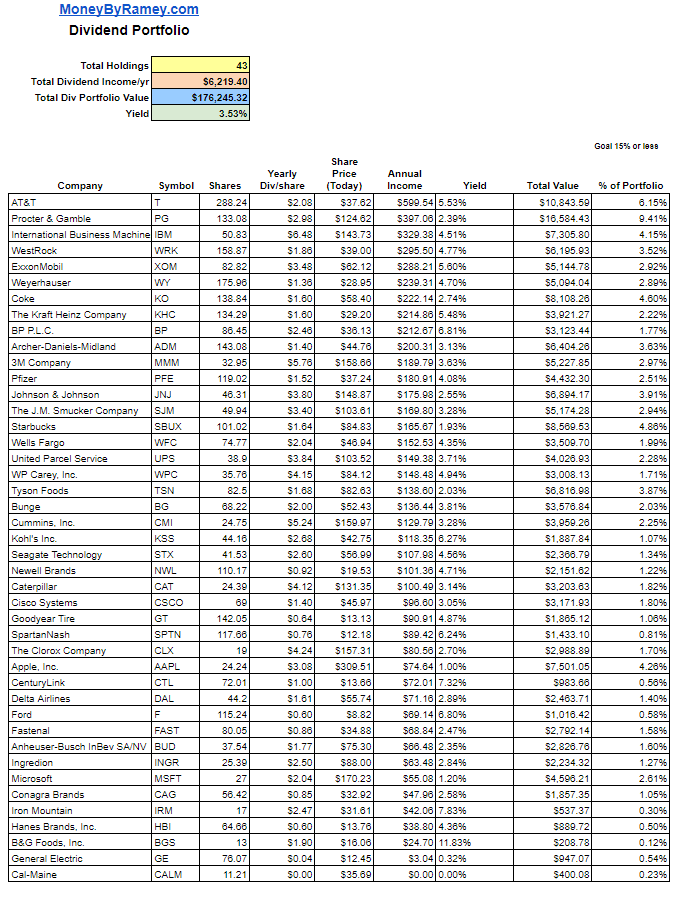

I personally reinvest all of my dividend stocks at the moment through a dividend reinvestment plan (DRIP), which allows me to continue accumulating larger and larger positions through both dividend increases and repurchasing of stocks.

The current result is a dividend portfolio that yields over $6,200 per year of annual dividend income which is being used to repurchase shares both in market upswings and market downswings.

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

#2 Great Companies at Great Prices During a Market Downturn

Whenever I see that the markets are down, especially when they are down for a few days in a row, I have condition my mindset to be one of excitement, as I know that the great companies I want to invest in are now going to be on sale.

What I find is that the overall market downturn which causes a particular company’s price to go lower and remain at a depressed value is usually due to macroeconomic conditions which of the company itself cannot do anything about.

When viewed from the lens that the company continues to perform at an adequate level and has solid fundamentals in place, savvy investors can rest assured that they are now buying into companies at even better prices.

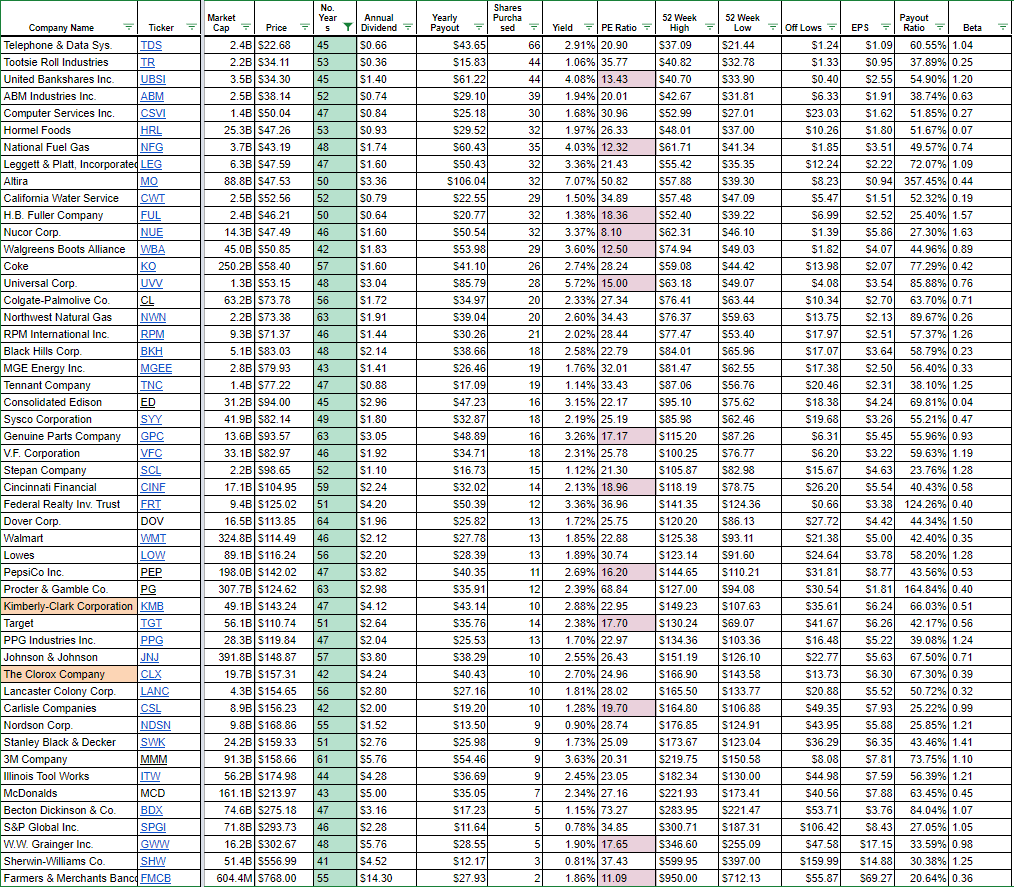

Just take a look at some of the stocks on my dividend stocks watchlist that have been paying dividends for 40 plus years.

Each one of these stocks has been through the ringer. They have gone through many challenging times: the 2002 dotcom bubble, the 2008 subprime crisis, and as far back as the interest rate crisis of 1980, and still lived to tell the tale.

This isn’t to say that just because these stocks have been successful in the past that they will be successful in the future. However, investors can certainly take solace in the fact of the solid performance of the stock over the many years of operation.

The goal is always the same: to be able to find great companies that are trading at great value points at any point in time and then deploy our hard-earned capital at that point. This can be challenging but well worth the effort to learn.

#3 “Grocery-Style” Shopping

I read a great entry in The Intelligent Investor <link> that has stuck with me ever since I’ve been buying stocks:

“Buy your stocks as if you were buying your groceries.”

Benjamin Graham, The Intelligent Investor

What this essentially means is that when investors are looking to buy stocks in the market, they should be looking for those companies that are currently on sale relative to the general market.

If we translate this metaphor to the actual grocery store, if an individual has two name brands in front of her which are both equally good products, more often than not, it is prudent for that individual to purchase the lower-priced product, as she is getting more “bang for her buck”.

This very simplified analogy provides great wisdom for value investors everywhere, especially those that follow the dividend investing strategy.

In watching the markets, knowing our investment criteria, and buying into companies that are trading at solid valuations relative to those criteria points, we can accumulate dividend and investment portfolios that perform very well over time as we are never buying dearly.

Not too long ago, the general markets were trading down on daily news of issues with the China-US trade deal. The market would overreact on a daily basis – selling dearly on news that the deal was at issue and buying up the markets on the latest positive tidbit.

During that time period, I was buying into new stock positions like crazy, knowing that the overall fundamentals of the markets and companies in the markets were in relatively good condition, it was just that Mr. Market <cite> was acting rather erratically due to no fault of those companies.

The result has been amazing. In buying companies during the market downturn, I have seen much appreciation in my stock positions and continue to buy more of those great companies through the DRIP program.

Personally, I am always hoping for a little bit of challenging news to drive the markets down, so that I can look to buy more shares in great companies at great prices.

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

#4 You Are Opposite the Trend (aka Mr. Market)

I’m personally a contrarian in most areas of my life. I do believe it benefits individuals to be against the trend in many scenarios. Nowhere is this more apparent than in the world of investing.

Benjamin Graham, Warren Buffett’s investing guru, often talked about how the general stock market’s irrationality would provide savvy investors opportunities to discover great deals in the market.

He had a term for the market craziness – Mister Market – who would often buy because everybody else was buying or sell because everybody else was selling.

This “herd mentality” can be seen in many ways in the investing community at large. Oftentimes, investors will believe nothing can go wrong during bull markets and thus, drives markets up to very high levels of overvaluation. This can and does often lead to excessive hubris which is the precursor to disaster.

Or contrast that to the doom and gloom present during long bear markets, in which investors never believe that stocks will recover.

Neither spectrum is where the investor wants to find him or herself.

If an investor is wise, they will understand that though they can never time the markets, they can definitely take profits when the market presents a solid opportunity to do so and buy great companies when the other investors are greatly discounting the intrinsic value of the stocks.

Note that in order to perform being opposite of the market one needs to truly master their emotions. This is definitely not easy.

I’ll be the first to admit that I love seeing my stock positions up, even though I know that this negatively affects me as a dividend investor as I am now buying shares through DRIP at higher prices.

Rather, I want to continue seeing that if a stock purchase I have made happens to be down from a value perspective, that is the time when I can be most excited as I can buy into companies at better prices to gain more share accumulation at a rapid pace.

I have found that for myself, it is taking much time, discipline, and reframing to view the short-term swings in the market not as the end-all-be-all, but rather keep the focus on the long-term, which means continuing to be invested through thick and thin.

The dividend investing strategy has definitely helped me become better at seeing the market downturn not as a disaster, but as an opportunity.

#5 Less Stress When I Know The Future Is Bright

While I will admit that market downturns will not in and of themselves bring less stress as no one likes to see their positions go down in value, adopting the mindset where we understand that stocks are ‘on sale’ and that things will turn around at some point in the future helps to greatly alleviate the stress associated with a market downturn.

Consider this example of a highly stressed individual: I have a friend, let’s call her Miss B. She is someone who would do well to let someone else manage your money.

This is because she watches her portfolio go up and down nearly every day and I can tell that her stress levels are through the roof.

On the days that are portfolio is up, she is ecstatic. The world is great, she can see the benefits in it of investing, and everything is coming together for the long term.

But those days that are down are definitely rough. Those days are characterized by watching the ticker’s every movement, wondering how and when things will ever get better, and – worst-case – panic selling solid companies at reduced prices.

Miss B has not yet adopted the mindset needed for long-term value investing. There are definitely risks associated with investing in the markets, and each individual needs to understand and know those risks. In and of itself, Miss B’s concerns are not invalid. There is definitely merit to her being concerned in a market downturn.

However, I would argue that she has the type of emotions that are not well suited to being a successful long-term investor.

Rather, someone like Miss B needs to outsource her investing to someone else or really works towards developing the mindset needed to divorce herself from everyday market fluctuations.

In the case of outsourcing her investments, there are many passively managed funds that will track the market. ETFs are a great place for someone like Miss B to start.

If however, she does want to manage her own investments, she will need to work hard at learning to approach investing from an emotion-free, analytical mindset.

The general rule of thumb is that if the markets are stressing you out and you watch each movement like a hawk, you either have to learn to control your emotions or focus your efforts elsewhere.

Life is too short to be on edge all the time.

#6 Fewer Mistakes By Holding

If you have been reading above, I’m hoping one of the biggest takeaways you have learned is that market downturns offer great opportunities to buy companies at great prices.

However, if one is following the trends of the market, which could induce panic selling a great stock at lower prices instead of buying into more of that stock, then the idea of investing loses a bit of its appeal.

Rather, when will you begin to welcome a market downturn and change our mindsets towards seeing the benefit of buying in more stock at lower prices, we become more serene and less mistake-prone in regards to investing.

Take for instance the story I heard from one of my family’s friends. During the 2008 and 2009 financial crisis, the person’s dad ended up selling all of his stock at the lowest point in the markets, mainly in a panic because the stock was losing value.

That panic sell was one of the worst financial decisions that the person had ever made. If they would have held on to those stocks go through today – Microsoft ($MSFT), Google ($GOOG), Coke ($KO), etc., – their positions would be many times the value of what they had previously lost.

This isn’t to say that we should take capital losses with a grain of salt. Protecting our principal in an investment is a very important part of what we’re doing as investors.

Rather the lesson here for me is to understand the reasons why we are investing, what we are investing in, and the strategies that we are implementing on a daily basis.

I find that by adopting a dividend investing strategy, I am buying into great companies, at great prices, and holding for the long-term.

If those stocks happen to go down during a financial crisis, or even just during a general market correction, I am actually happier because now I can buy more of the stock through averaging down and through dividend reinvestment.

Not only does this investment strategy bring me more peace concerning my financial choices, but it also keeps me from making errant mistakes. If I was only concerned about capital appreciation, there might be the tendency for me to sell out at points which would later prove to be a mistake.

In my “buy and hold forever” strategy explained in my book, Simple Investing, I’m confident holding the companies in which I am investing throughout my entire life span. In fact, the goal is to never sell out of a company unless serious issues in fundamentals occur.

#7 Realization That I Cannot Time the Market

When you welcome market downturns, your mindset changes from that of believing you can pick the top or the bottom to that of seeing that a downturn presents a better opportunity to buy more stock at more reasonable pricing.

I’m always amazed that this day in age that people think that they can time the market in a way as to generate superior market returns. However, history has shown over and over again, that even the best traders and computer-generated algorithms are no match for the insanity of Mr. Market.

Therefore, in adopting an attitude and understanding that the market cannot be timed, investors become more open to the idea of being disconnected to which direction the overall market is currently heading.

Once I remove the idea of market timing from my mindset, my overarching goal becomes buying into companies once reasonable valuation points present itself.

So long as a particular investment passes my due diligence test and fits my personal investment criteria, I am firm in my idea that purchasing that stock is a great proposition.

#8 Firming the Ownership Mindset

In welcoming market downturns, investors realize that the companies that they own or not just numbers out in cyberspace, but represent real ownership in the various companies they are invested in.

By adopting this mentality, investors can be better geared towards continuing to hold their positions in some of the best companies the world over.

Picture yourself as the owner of a business. Times are good and a banker tells you that your business is worth $1 million dollars. That is great news and you can feel on top of the world.

Well let’s say that the business is still good, but one month later that banker tells you that now, because of forces beyond your control, your business is only worth $750,000.

Would you immediately think to yourself, “wow, I have to sell this thing.”

Or maybe would you realize that business is still good and that now might represent a chance to get more equity at a lower price? Or even balk at the fact that the price is pushed down to unreasonable levels and that it will eventually return to normal conditions?

What I’ve learned is that so long as fundamentals are in place – i.e. debt is under control, profits and cash flows are strong, no material lawsuits outstanding, etc. – a market downturn represents a fantastic opportunity for long-term value investors to acquire more shares of great companies.

See yourself as an owner and you will begin to execute this strategy instead of panicking when the market trends lower.

#9 Lower Fees

In welcoming market downturns, you do more to maximize portfolio gains than if you panic sell on the way down.

A good rule of thumb is: the more active you are in the market, the more fees you will incur and the less profit you will make.

In fact, it has been shown that investors who put their money in a passively managed fund tend to outperform those who invest with an active-oriented investment manager.

Since we know we cannot time the markets, this math makes sense.

And the beautiful part about the dividend investing strategy is that we are buying more of the great companies at (now) lower prices during a market downturn.

The caveat to this is that the companies we invest in must have great fundamentals and be long-term value plays. If we buy and sell like day traders and focus only on share appreciation, we will certainly be doomed for failure.

Even though most brokerages are offering $0 trades these days, those that buy and hold long-term (i.e. forever) incur much lower costs – if any – on the positions in their dividend portfolios.

#10 Time Freedom

The last great benefit to welcoming market downturns is the fact that we don’t need to spend all the extra time monitoring and watching our positions or initiating trades trying to protect our capital.

I’m a firm believer that if we have done the legwork on the front end in the companies that we are investing in, we can be more confident in the long-term potential of the stock.

While we want to continue monitoring our portfolios for material deterioration in fundamentals, we can largely ignore market trends and hold through both bear and bull markets.

Not only does this mentality lead to an excellent amount of stress-free living, but we also gain a good amount of time freedom through not having to worry or monitor our portfolios.

I am naturally a Christian upbringing and have also followed Zen teachings, which led me into the world of minimalism.

I believe that investing in solid companies and trusting in the long-term results is almost a form of monetary spirituality in the sense that we welcome anything and everything that might happen in the markets as a whole.

Therefore, if the markets are up that is excellent. If the markets are down, that is excellent too.

It is from this peaceful place that we can begin to trust that our positions are being added to on a consistent basis and that long-term growth is our great friend.

Welcoming Market Downturns: Easier Said than Done

The markets are up, the markets are down. Such is life.

The mindset shift towards seeing a market downturn as an opportunity and not a disaster is very challenging – perhaps impossible – for many.

This is because as Financial Freedom seekers, we all love to see our long-term investments go up in value. Especially when it comes to our stock portfolios, nothing feels better than seeing those little number signals in green. This is our inherent human nature which always wants to avoid loss and risk.

As an investor, a lot of me wants to see my stocks increasing in value. To me, this signals that the broader market finds value in the stock position and is willing to bid up the stock price to an appreciable level.

While appreciation is definitely a good thing, I have changed my mindset over many years to seeing down markets as opportunities. It was not easy, and it did take a long time, but the results were well worth the reward.

I now have a dividend portfolio that yields $6200+ in annual dividend income (ADI) and continues to grow as I add more positions through DRIP.

Personally, I would much rather see stocks trading at a discount in which I can increase my ownership share at a higher rate than when the companies are trading at a premium relative to historical values.

So When Will The Next Market Downturn Occur?

I don’t know and I don’t particularly care. I continue to buy great companies, at great prices, and hold for the long-term.

So far, so good.

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CAG $CAT $CLX $CMI $COF $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LUMN $MMM $MSFT $NWL $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $T $TSN $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!